CB2 Question Bank

Quiz-summary

0 of 999 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

Information

CB2 Question Bank

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Your Result

You scored 0 of 0 points, (0)0 of 999 questions answered correctly

Time Taken:

Time has elapsed

Categories

- Not categorized 0%

- CB2 IAI FEB 2025 DIET 0%

- CB2- CB2 M4 0%

- CB2- CB2 M5 0%

- CB2- CB2 X1 Mock 0%

- CB2- CB2 X2 Mock 0%

- CB2- CB2 X3 Mock 0%

- CB2- CB2 X4 Mock 0%

- CB2- CB2 X5 Mock 0%

- CB2- CB2 X6 Mock 0%

- CB2- CB2 X7 Mock 0%

- CB2- CB2 X8 Mock 0%

- Cb2- TV CB2 Background to demand 0%

- Cb2- TV CB2 Background to supply 0%

- Cb2- TV CB2 Balance of payments and exchange rates 0%

- Cb2- TV CB2 Classical and keynesian theory 0%

- Cb2- TV CB2 Debates on theory and policy 0%

- Cb2- TV CB2 Demand-side policy 0%

- Cb2- TV CB2 Economic concepts and systems 0%

- Cb2- TV CB2 Exchange rate policy 0%

- Cb2- TV CB2 Global harmonisation / union 0%

- Cb2- TV CB2 International trade 0%

- Cb2- TV CB2 Macroeconomic objectives 0%

- Cb2- TV CB2 Main strands of economic thinking 0%

- Cb2- TV CB2 Market failure and government intervention 0%

- Cb2- TV CB2 Monetarist and new classical schools, keynesian responses 0%

- Cb2- TV CB2 Monopolistic competition and oligopoly 0%

- Cb2- TV CB2 Perfect competition and monopoly 0%

- Cb2- TV CB2 Pricing strategies 0%

- Cb2- TV CB2 Relationship between the goods and the money markets 0%

- Cb2- TV CB2 Supply and demand(1) 0%

- Cb2- TV CB2 Supply and demand(2) 0%

- Cb2- TV CB2 Supply-side policy 0%

- Cb2- TV CB2 The financial system 0%

- Cb2- TV CB2 The macroeconomic environment 0%

- Cb2- TV CB2 The money market and monetary policy 0%

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- 568

- 569

- 570

- 571

- 572

- 573

- 574

- 575

- 576

- 577

- 578

- 579

- 580

- 581

- 582

- 583

- 584

- 585

- 586

- 587

- 588

- 589

- 590

- 591

- 592

- 593

- 594

- 595

- 596

- 597

- 598

- 599

- 600

- 601

- 602

- 603

- 604

- 605

- 606

- 607

- 608

- 609

- 610

- 611

- 612

- 613

- 614

- 615

- 616

- 617

- 618

- 619

- 620

- 621

- 622

- 623

- 624

- 625

- 626

- 627

- 628

- 629

- 630

- 631

- 632

- 633

- 634

- 635

- 636

- 637

- 638

- 639

- 640

- 641

- 642

- 643

- 644

- 645

- 646

- 647

- 648

- 649

- 650

- 651

- 652

- 653

- 654

- 655

- 656

- 657

- 658

- 659

- 660

- 661

- 662

- 663

- 664

- 665

- 666

- 667

- 668

- 669

- 670

- 671

- 672

- 673

- 674

- 675

- 676

- 677

- 678

- 679

- 680

- 681

- 682

- 683

- 684

- 685

- 686

- 687

- 688

- 689

- 690

- 691

- 692

- 693

- 694

- 695

- 696

- 697

- 698

- 699

- 700

- 701

- 702

- 703

- 704

- 705

- 706

- 707

- 708

- 709

- 710

- 711

- 712

- 713

- 714

- 715

- 716

- 717

- 718

- 719

- 720

- 721

- 722

- 723

- 724

- 725

- 726

- 727

- 728

- 729

- 730

- 731

- 732

- 733

- 734

- 735

- 736

- 737

- 738

- 739

- 740

- 741

- 742

- 743

- 744

- 745

- 746

- 747

- 748

- 749

- 750

- 751

- 752

- 753

- 754

- 755

- 756

- 757

- 758

- 759

- 760

- 761

- 762

- 763

- 764

- 765

- 766

- 767

- 768

- 769

- 770

- 771

- 772

- 773

- 774

- 775

- 776

- 777

- 778

- 779

- 780

- 781

- 782

- 783

- 784

- 785

- 786

- 787

- 788

- 789

- 790

- 791

- 792

- 793

- 794

- 795

- 796

- 797

- 798

- 799

- 800

- 801

- 802

- 803

- 804

- 805

- 806

- 807

- 808

- 809

- 810

- 811

- 812

- 813

- 814

- 815

- 816

- 817

- 818

- 819

- 820

- 821

- 822

- 823

- 824

- 825

- 826

- 827

- 828

- 829

- 830

- 831

- 832

- 833

- 834

- 835

- 836

- 837

- 838

- 839

- 840

- 841

- 842

- 843

- 844

- 845

- 846

- 847

- 848

- 849

- 850

- 851

- 852

- 853

- 854

- 855

- 856

- 857

- 858

- 859

- 860

- 861

- 862

- 863

- 864

- 865

- 866

- 867

- 868

- 869

- 870

- 871

- 872

- 873

- 874

- 875

- 876

- 877

- 878

- 879

- 880

- 881

- 882

- 883

- 884

- 885

- 886

- 887

- 888

- 889

- 890

- 891

- 892

- 893

- 894

- 895

- 896

- 897

- 898

- 899

- 900

- 901

- 902

- 903

- 904

- 905

- 906

- 907

- 908

- 909

- 910

- 911

- 912

- 913

- 914

- 915

- 916

- 917

- 918

- 919

- 920

- 921

- 922

- 923

- 924

- 925

- 926

- 927

- 928

- 929

- 930

- 931

- 932

- 933

- 934

- 935

- 936

- 937

- 938

- 939

- 940

- 941

- 942

- 943

- 944

- 945

- 946

- 947

- 948

- 949

- 950

- 951

- 952

- 953

- 954

- 955

- 956

- 957

- 958

- 959

- 960

- 961

- 962

- 963

- 964

- 965

- 966

- 967

- 968

- 969

- 970

- 971

- 972

- 973

- 974

- 975

- 976

- 977

- 978

- 979

- 980

- 981

- 982

- 983

- 984

- 985

- 986

- 987

- 988

- 989

- 990

- 991

- 992

- 993

- 994

- 995

- 996

- 997

- 998

- 999

-

Question 1 of 999CB2023165

Question 1

FlagWhich one of the following statements about market structure is FALSE?

Correct

The correct answer is B.

EXPLANATIONPerfect competition is a market structure characterized by many buyers and sellers engaged in the production and

exchange of homogeneous products. Each firm is so small relative to the whole industry that it has no power to

influence price. Firms are price takers meaning that they accept the prevailing market price. Also, there is complete

freedom of entry into the industry for new firms. In the long run, if typical firms are making supernormal profits,

new firms will be attracted into the industry to take advantage of the profitable conditions. As more firms enter, the

market or industry supply increases, leading to a decrease in price. This decrease in price reduces the profitability of

individual firms, eventually eroding supernormal profits until firms make only normal profits.

Monopolistic competition is a market structure where, as with perfect competition, there are many firms and freedom

of entry into the industry, but where each firm produces a differentiated product and thus has some control over its

price. As a result, it can raise its price without losing all its customers.

An oligopoly is a market that is dominated by a small number of firms. In contrast to the situation under

monopolistic competition, there are various barriers to the entry of new firms. Also, the firms are interdependent, and

each firm is affected by its rivals’ actions.

A monopoly exists when there is only one firm in the industry. Compared with other market structures, demand

under monopoly will be relatively inelastic at each price. A monopolist will maximise profit where MR= MC.

Hence, the FALSE statement is that, firms under monopolistic competition produce homogeneous products.Incorrect

The correct answer is B.

EXPLANATIONPerfect competition is a market structure characterized by many buyers and sellers engaged in the production and

exchange of homogeneous products. Each firm is so small relative to the whole industry that it has no power to

influence price. Firms are price takers meaning that they accept the prevailing market price. Also, there is complete

freedom of entry into the industry for new firms. In the long run, if typical firms are making supernormal profits,

new firms will be attracted into the industry to take advantage of the profitable conditions. As more firms enter, the

market or industry supply increases, leading to a decrease in price. This decrease in price reduces the profitability of

individual firms, eventually eroding supernormal profits until firms make only normal profits.

Monopolistic competition is a market structure where, as with perfect competition, there are many firms and freedom

of entry into the industry, but where each firm produces a differentiated product and thus has some control over its

price. As a result, it can raise its price without losing all its customers.

An oligopoly is a market that is dominated by a small number of firms. In contrast to the situation under

monopolistic competition, there are various barriers to the entry of new firms. Also, the firms are interdependent, and

each firm is affected by its rivals’ actions.

A monopoly exists when there is only one firm in the industry. Compared with other market structures, demand

under monopoly will be relatively inelastic at each price. A monopolist will maximise profit where MR= MC.

Hence, the FALSE statement is that, firms under monopolistic competition produce homogeneous products. -

Question 2 of 999CB2023166

Question 2

FlagAn economy with a floating exchange rate has a large deficit on the current account of its balance of

payments. Which policy combination would be most likely to reduce this deficit?Correct

The correct answer is D.

EXPLANATIONWhen a country has current account deficits, it implies the country is importing more than it is exporting to the rest

of the word. Policy combinations should be targeted at reducing imports and encouraging exports. The right answer

is option D. When interest rates are increased, it reduces money demand which leads to a reduction in domestic

demand. This will decrease the demand for imports and improve the current account balance. Also, increasing

income tax rates will decrease domestic demand and hence, the demand for imports.Incorrect

The correct answer is D.

EXPLANATIONWhen a country has current account deficits, it implies the country is importing more than it is exporting to the rest

of the word. Policy combinations should be targeted at reducing imports and encouraging exports. The right answer

is option D. When interest rates are increased, it reduces money demand which leads to a reduction in domestic

demand. This will decrease the demand for imports and improve the current account balance. Also, increasing

income tax rates will decrease domestic demand and hence, the demand for imports. -

Question 3 of 999CB2023167

Question 3

FlagVertical product differentiation refers to differences between products which reflect:

Correct

The correct answer is C.

EXPLANATIONVertical product differentiation is a type of product differentiation that occurs when a firm supplies different products

that have different qualities to the same market, and consumers see the difference in qualities based on their tastes for

the products. Producers employ vertical differentiation because of different costs incurred in producing products with

differing qualities, and as a strategy to charge different prices for their products.

Apple is an example of a company that employs vertical differentiation. This is feasible in the production of different

iPhone models such as the iPhone 14 Mini, iPhone 14 Pro, and iPhone 14 Pro Max, which differ in terms of their

features.Incorrect

The correct answer is C.

EXPLANATIONVertical product differentiation is a type of product differentiation that occurs when a firm supplies different products

that have different qualities to the same market, and consumers see the difference in qualities based on their tastes for

the products. Producers employ vertical differentiation because of different costs incurred in producing products with

differing qualities, and as a strategy to charge different prices for their products.

Apple is an example of a company that employs vertical differentiation. This is feasible in the production of different

iPhone models such as the iPhone 14 Mini, iPhone 14 Pro, and iPhone 14 Pro Max, which differ in terms of their

features. -

Question 4 of 999CB2023168

Question 4

FlagFinancial intermediaries play a crucial role in maintaining a well-functioning and efficient financial

system. The definition below describes the role or service of financial intermediaries. Select the option that best fits

this definition.

“The process whereby banks can spread the risks of lending by having a large number of borrowers.”Correct

The correct answer is B.

EXPLANATIONFinancial intermediaries are the general name for financial institutions (banks, building societies, etc.) that act as a

means of channeling funds from depositors to borrowers. They typically provide five important services/roles:

i. Expert advice, which may include offering an expert opinion on saving and investment activities or information

about other sources of finance.

ii.

0

A

Allocative efficiency, where financial intermediaries offer expertise in how to channel funds into activities that

have higher returns and balance the viability of loans against risks.

iii. Maturity transformation, where financial institutions facilitate the transformation of deposits into loans of longer

maturity.

iv. Risk transformation, which is the process whereby banks can spread the risks of lending by having a large number

of borrowers.

v. Transmission of funds, where money can be transferred from one person or institution to another without having to

rely on cash.Incorrect

The correct answer is B.

EXPLANATIONFinancial intermediaries are the general name for financial institutions (banks, building societies, etc.) that act as a

means of channeling funds from depositors to borrowers. They typically provide five important services/roles:

i. Expert advice, which may include offering an expert opinion on saving and investment activities or information

about other sources of finance.

ii.

0

A

Allocative efficiency, where financial intermediaries offer expertise in how to channel funds into activities that

have higher returns and balance the viability of loans against risks.

iii. Maturity transformation, where financial institutions facilitate the transformation of deposits into loans of longer

maturity.

iv. Risk transformation, which is the process whereby banks can spread the risks of lending by having a large number

of borrowers.

v. Transmission of funds, where money can be transferred from one person or institution to another without having to

rely on cash. -

Question 5 of 999CB2023169

Question 5

FlagA consumer has 200 rupees of income, which is spent entirely on two goods, Good X and Good Y. Good

X costs 40 rupees per unit and Good Y costs 40 rupees per unit. The relevant marginal utilities (MUs) for the

consumer are:$\begin{array}{|c|c|c|c|}

\hline \begin{array}{c}

\text { Good X } \\

\text { Quantity (in units) }

\end{array} & \text { Good X MU } & \begin{array}{c}

\text { Good Y } \\

\text { Quantity (in units) }

\end{array} & \text { Good Y MU } \\

\hline 1 & 100 & 1 & 70 \\

\hline 2 & 80 & 2 & 50 \\

\hline 3 & 50 & 3 & 40 \\

\hline 4 & 25 & 4 & 30 \\

\hline 5 & 10 & 5 & 20 \\

\hline

\end{array}$The optimum combination of units of Good X and Good Y for the consumer to purchase is:

Correct

The correct answer is C.

EXPLANATIONThe optimum combination of goods X for Y occurs when the marginal utilities ( MU x / MUy) equal the ratio of the

prices of the two goods (Px /Py). From the question, Px / Py = 40 / 40 = 1. Hence the optimum combination

occurs by purchasing three units of Good X and two units of Good Y, which gives MU x / MUy = 50 / 50 = 1.

Alternatively, the total consumer surplus is given by

Total Consumer Surplus (TCS) = Total Utility- Total Expenditure.

The optimum combination of units of Good X and Good Y for the consumer to purchase is the combination that

gives the highest TCS. From the options, purchasing three units of Good X and two units of Good Y produces

TCS = (100 + 80 + 50) + (70 + 50) – 200 = 150, which is the highest TCS.Incorrect

The correct answer is C.

EXPLANATIONThe optimum combination of goods X for Y occurs when the marginal utilities ( MU x / MUy) equal the ratio of the

prices of the two goods (Px /Py). From the question, Px / Py = 40 / 40 = 1. Hence the optimum combination

occurs by purchasing three units of Good X and two units of Good Y, which gives MU x / MUy = 50 / 50 = 1.

Alternatively, the total consumer surplus is given by

Total Consumer Surplus (TCS) = Total Utility- Total Expenditure.

The optimum combination of units of Good X and Good Y for the consumer to purchase is the combination that

gives the highest TCS. From the options, purchasing three units of Good X and two units of Good Y produces

TCS = (100 + 80 + 50) + (70 + 50) – 200 = 150, which is the highest TCS. -

Question 6 of 999CB2023171

Question 6

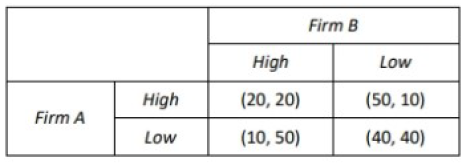

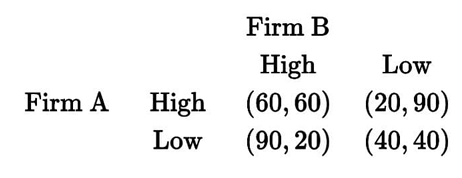

FlagTwo firms operate in a duopoly, but do not collude. Given the profit pay-off matrix of output options to

Firms A and B below, what is the dominant strategy for the firms?

[Note: Profit pay-offs are ‘(profit A, profit B)’, and ‘high’ and ‘low’ refer to the price decision of the firms.]

Correct

The correct answer is C.

EXPLANATIONIf firm A looks at the pricing decision from firm B’s point of view, it will show that firm B has a dominant strategy. If

firm A charges High, it can see that firm B’s best response is to charge Low (making a profit of 90 rather than 60). If

firm A charges Low, firm B’s best response is also to charge Low (making a profit of 40 rather than 20). Therefore,

firm A can predict with a high level of certainty that firm B will charge Low – its dominant strategy. Firm A’s best

response, therefore, is to charge Low and make a profit of 40 rather than 20. Hence the dominant strategy for the

firms is Firm A-Low; Firm B – Low.Incorrect

The correct answer is C.

EXPLANATIONIf firm A looks at the pricing decision from firm B’s point of view, it will show that firm B has a dominant strategy. If

firm A charges High, it can see that firm B’s best response is to charge Low (making a profit of 90 rather than 60). If

firm A charges Low, firm B’s best response is also to charge Low (making a profit of 40 rather than 20). Therefore,

firm A can predict with a high level of certainty that firm B will charge Low – its dominant strategy. Firm A’s best

response, therefore, is to charge Low and make a profit of 40 rather than 20. Hence the dominant strategy for the

firms is Firm A-Low; Firm B – Low. -

Question 7 of 999CB2023172

Question 7

FlagIdentify which one of the following would NOT constitute a demand-side economic policy for reducing

unemployment.Correct

The correct answer is D.

EXPLANATIONEconomic activities can be broadly divided into the supply side and the demand side. The supply side refers to the

level of production or output in an economy, which is determined by resources such as labor, capital, and natural

endowment. The level of supply can also be influenced by factors that affect the availability of these resources, such

as their cost and efficiency. On the other hand, the demand side is typically determined by government spending,

consumption, and private investment. The level of consumption can be influenced by factors such as consumer

preferences, interest rates, and the money supply.

Therefore, policies such as cutting interest rates can increase consumption and private investment, resulting in a

decrease in unemployment and an increase in output. Similarly, when the government implements policies that

increase the money supply or its own spending, the level of economic activity can rise, leading to a decrease in

unemployment.

Privatisation policies involve transferring the ownership of businesses from the government to private citizens and

are generally categorized as supply-side policies. If privatization increases efficiency and leads to an increase in the

production of goods and services, then unemployment can decline. However, this is a supply-side effect, not a

demand-side effect. Therefore, option D is the correct answer.Incorrect

The correct answer is D.

EXPLANATIONEconomic activities can be broadly divided into the supply side and the demand side. The supply side refers to the

level of production or output in an economy, which is determined by resources such as labor, capital, and natural

endowment. The level of supply can also be influenced by factors that affect the availability of these resources, such

as their cost and efficiency. On the other hand, the demand side is typically determined by government spending,

consumption, and private investment. The level of consumption can be influenced by factors such as consumer

preferences, interest rates, and the money supply.

Therefore, policies such as cutting interest rates can increase consumption and private investment, resulting in a

decrease in unemployment and an increase in output. Similarly, when the government implements policies that

increase the money supply or its own spending, the level of economic activity can rise, leading to a decrease in

unemployment.

Privatisation policies involve transferring the ownership of businesses from the government to private citizens and

are generally categorized as supply-side policies. If privatization increases efficiency and leads to an increase in the

production of goods and services, then unemployment can decline. However, this is a supply-side effect, not a

demand-side effect. Therefore, option D is the correct answer. -

Question 8 of 999CB2023173

Question 8

FlagIn Country A, government expenditure is £350 billion, tax revenue is £275 billion, aggregate saving is

£300 billion and aggregate investment is £250 billion. The net exports of Country A are equal to a:Correct

The correct answer is D.

EXPLANATIONThe national income identity for an open economy can be written in this form

S-l=X-M

Where S – I is the net capital outflow and X – M is the net exports or trade balance.

S is national saving which is a sum of public saving (T-G) and private saving (Y-C-T).

Public saving= 275-350 = -£75 billion.

This implies that National savings= 300-75 = £225 billion.

Now from the identity,225-250 = X-M

X- M = – pounds 25 billion

Net export is a deficit of £25 billion.Incorrect

The correct answer is D.

EXPLANATIONThe national income identity for an open economy can be written in this form

S-l=X-M

Where S – I is the net capital outflow and X – M is the net exports or trade balance.

S is national saving which is a sum of public saving (T-G) and private saving (Y-C-T).

Public saving= 275-350 = -£75 billion.

This implies that National savings= 300-75 = £225 billion.

Now from the identity,225-250 = X-M

X- M = – pounds 25 billion

Net export is a deficit of £25 billion. -

Question 9 of 999CB2023175

Question 9

FlagIdentify which of the following factors could cause a country’s aggregate demand curve to shift outward

to the right.Correct

The correct answer is B.

EXPLANATIONThe correct answer is option B. A shift in the aggregate demand curve to the right implies an increase in aggregate

demand. Depreciation in the exchange rate will make exports cheaper and imports more expensive. This improves

the net exports component of GDP and hence causes an increase in aggregate demand. This will cause the aggregate

demand curve to shift to the right. All the other options will cause aggregate demand to decrease.Incorrect

The correct answer is B.

EXPLANATIONThe correct answer is option B. A shift in the aggregate demand curve to the right implies an increase in aggregate

demand. Depreciation in the exchange rate will make exports cheaper and imports more expensive. This improves

the net exports component of GDP and hence causes an increase in aggregate demand. This will cause the aggregate

demand curve to shift to the right. All the other options will cause aggregate demand to decrease. -

Question 10 of 999CB2023176

Question 10

FlagIn a simple closed economy with no government sector, the consumption function relating consumption

(C) to income (Y) is given by the expression:

C = £80 million + 0. 75Y

Planned investment is constant at £50 million.

Which of the following is TRUE?Correct

The correct answer is B.

EXPLANATIONIn a simple closed economy with no government sector, we have:

Y=C+I

where C = consumption function; and I= investment expenditure. Given C = £80million + 0. 75Y and

I = £ 50million, then:

Y = £80million + 0.75Y + I

0.25Y = £80million + £50million

Then, equilibrium income Y = £520million. Therefore, consumption will be

C = £80million + 0.75Y = £80million + 0.75 x £520million = £470million.Incorrect

The correct answer is B.

EXPLANATIONIn a simple closed economy with no government sector, we have:

Y=C+I

where C = consumption function; and I= investment expenditure. Given C = £80million + 0. 75Y and

I = £ 50million, then:

Y = £80million + 0.75Y + I

0.25Y = £80million + £50million

Then, equilibrium income Y = £520million. Therefore, consumption will be

C = £80million + 0.75Y = £80million + 0.75 x £520million = £470million. -

Question 11 of 999CB2023177

Question 11

FlagA consumer’s demand curve for Good X is represented by the equation:

Qdx = 50 – 0.2Px

where Q dx is the quantity of Good X demanded and Px is the price of Good X.

A producer’s supply curve for Good X is represented by the equation:

Qsx = 10 + 0.6Px

where Qsx is the quantity of Good X supplied and Px is the price of Good X.

Demand and supply are in equilibrium when:Correct

The correct answer is D.

EXPLANATIONGiven the equations for the supply and demand as:

Qdx = 50 – 0.2Px

Qsx = 10 + 0.6PxWe can find the market equilibrium price by setting the two equations equal to each other, since, in equilibrium, the

quantity supplied (Qsx) equals the quantity demanded (Qdx). Thus:

50 – 0.2Px = 10 + 0.6Px

40 = 0.8Px

which solves for Px = 50.

We can then solve for equilibrium quantity (Qe) by substituting Px = 50 into the demand or supply equations (since Qdx = Qsx). Thus, from the demand equation:

Qe = 50 – 0.2Px = 50 – 0.2(50) = 40

Then demand and supply are in equilibrium when: quantity is 40 and price is 50.Incorrect

The correct answer is D.

EXPLANATIONGiven the equations for the supply and demand as:

Qdx = 50 – 0.2Px

Qsx = 10 + 0.6PxWe can find the market equilibrium price by setting the two equations equal to each other, since, in equilibrium, the

quantity supplied (Qsx) equals the quantity demanded (Qdx). Thus:

50 – 0.2Px = 10 + 0.6Px

40 = 0.8Px

which solves for Px = 50.

We can then solve for equilibrium quantity (Qe) by substituting Px = 50 into the demand or supply equations (since Qdx = Qsx). Thus, from the demand equation:

Qe = 50 – 0.2Px = 50 – 0.2(50) = 40

Then demand and supply are in equilibrium when: quantity is 40 and price is 50. -

Question 12 of 999CB2023179

Question 12

FlagIn the short run, a loss-making firm that seeks to maximise profits will continue to produce if:

Correct

The correct answer is D.

EXPLANATIONFixed costs have to be paid even if the firm is producing nothing at all, hence we will assume all fixed costs are also

sunk costs. This means that providing the firm is able to cover its variable costs, it is no worse off than it would be if

it temporarily shut down. Therefore, in the short run, a loss making firm that seeks to maximise profits will

continue to produce if: it can charge a price greater than its average variable cost.Incorrect

The correct answer is D.

EXPLANATIONFixed costs have to be paid even if the firm is producing nothing at all, hence we will assume all fixed costs are also

sunk costs. This means that providing the firm is able to cover its variable costs, it is no worse off than it would be if

it temporarily shut down. Therefore, in the short run, a loss making firm that seeks to maximise profits will

continue to produce if: it can charge a price greater than its average variable cost. -

Question 13 of 999CB2023180

Question 13

FlagStructural unemployment is unemployment that:

Correct

The correct answer is B.

EXPLANATIONStructural unemployment is a type of unemployment that occurs when the skills of workers in certain industries do

not match the available jobs. This type of unemployment is usually caused by changes in the structure of an

economy, such as a change in consumer preferences.Incorrect

The correct answer is B.

EXPLANATIONStructural unemployment is a type of unemployment that occurs when the skills of workers in certain industries do

not match the available jobs. This type of unemployment is usually caused by changes in the structure of an

economy, such as a change in consumer preferences. -

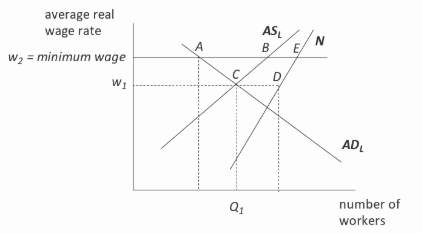

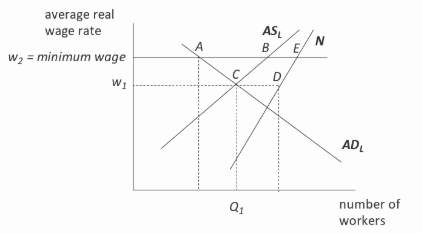

Question 14 of 999CB2023181

Question 14

FlagIf the government imposes a minimum wage that is above the market equilibrium wage, we would expect:

Correct

The correct answer is C.

EXPLANATIONSuppose the government imposes a minimum wage above the market equilibrium wage. In that case, there will be

an increase in the quantity of labor supplied, which leads to surplus labor. The reason is that more people will be

willing to work (an increase in labor supply) to enjoy the new higher wage.Incorrect

The correct answer is C.

EXPLANATIONSuppose the government imposes a minimum wage above the market equilibrium wage. In that case, there will be

an increase in the quantity of labor supplied, which leads to surplus labor. The reason is that more people will be

willing to work (an increase in labor supply) to enjoy the new higher wage. -

Question 15 of 999CB2023182

Question 15

FlagOne way of reducing the natural rate of unemployment would be to increase:

Correct

The correct answer is C.

EXPLANATIONThe natural rate of unemployment is made up of frictional unemployment and structural unemployment. Frictional

unemployment occurs when workers are in transition between jobs. Structural unemployment occurs due to a

mismatch between the skills and qualifications of job seekers and the job opportunities that are available. Policies

targeted at reducing these two types of unemployment will reduce the natural rate of unemployment. Providing

information about job availability will reduce the transition periods between jobs, and hence reduce frictional

unemployment. The correct answer is option C.Incorrect

The correct answer is C.

EXPLANATIONThe natural rate of unemployment is made up of frictional unemployment and structural unemployment. Frictional

unemployment occurs when workers are in transition between jobs. Structural unemployment occurs due to a

mismatch between the skills and qualifications of job seekers and the job opportunities that are available. Policies

targeted at reducing these two types of unemployment will reduce the natural rate of unemployment. Providing

information about job availability will reduce the transition periods between jobs, and hence reduce frictional

unemployment. The correct answer is option C. -

Question 16 of 999CB2023183

Question 16

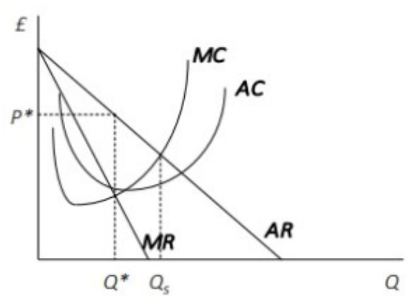

FlagThe socially efficient output for a monopoly is at the point where:

Correct

The correct answer is B.

EXPLANATIONThe price is determined in the industry by the intersection of demand and supply. Under perfect competition, the rule

of profit maximization is for each firm to produce the quantity of output where P = MC. The price (P) reflects

demand and as such, is a measure of how much buyers value the good, while the marginal cost (MC) is a measure of

what additional units of output cost society to produce. Following this rule assures allocative efficiency. However, in

the case of the monopoly, at the profit-maximizing level of output, the price is always greater than the marginal cost.

If P > MC, then the marginal benefit to society (as measured by P) is greater than the marginal cost to society of

producing additional units, and a greater quantity should be produced; and yet the the monopolist is deliberately

holding back, so as to keep its profits up.

Hence, the socially efficient output for a monopoly is at the point where: the marginal cost curve cuts the

demand curve.Incorrect

The correct answer is B.

EXPLANATIONThe price is determined in the industry by the intersection of demand and supply. Under perfect competition, the rule

of profit maximization is for each firm to produce the quantity of output where P = MC. The price (P) reflects

demand and as such, is a measure of how much buyers value the good, while the marginal cost (MC) is a measure of

what additional units of output cost society to produce. Following this rule assures allocative efficiency. However, in

the case of the monopoly, at the profit-maximizing level of output, the price is always greater than the marginal cost.

If P > MC, then the marginal benefit to society (as measured by P) is greater than the marginal cost to society of

producing additional units, and a greater quantity should be produced; and yet the the monopolist is deliberately

holding back, so as to keep its profits up.

Hence, the socially efficient output for a monopoly is at the point where: the marginal cost curve cuts the

demand curve. -

Question 17 of 999CB2023184

Question 17

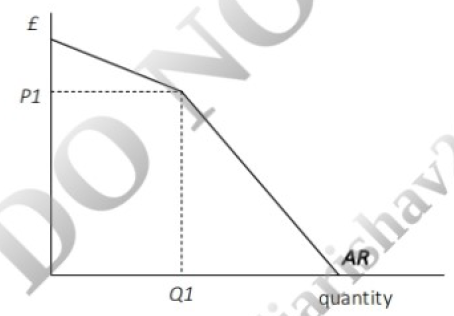

FlagA profit-maximising monopoly facing a linear demand schedule and having positive marginal costs will

set its price in the region of the demand curve where the absolute price elasticity of demand is:Correct

The correct answer is A.

EXPLANATIONBecause the monopolist is a price maker, prices will always be set in the region where the demand curve is elastic.

When the monopolist starts off on the inelastic part of the demand curve, there is always the possibility that revenues

can be increased by restricting output and charging higher prices. Also, with positive marginal cost, a reduction in

output reduces the total cost of production. This means that for the monopolist, as long as demand is inelastic, the

monopolist will keep reducing output and charging higher prices. Hence the monopolist continues to move up on the

demand curve until he enters the elastic portion of the demand curve. Hence, equilibrium is only possible on the

elastic portion of the demand curve (Elasticity is greater than I).

The right answer is option AIncorrect

The correct answer is A.

EXPLANATIONBecause the monopolist is a price maker, prices will always be set in the region where the demand curve is elastic.

When the monopolist starts off on the inelastic part of the demand curve, there is always the possibility that revenues

can be increased by restricting output and charging higher prices. Also, with positive marginal cost, a reduction in

output reduces the total cost of production. This means that for the monopolist, as long as demand is inelastic, the

monopolist will keep reducing output and charging higher prices. Hence the monopolist continues to move up on the

demand curve until he enters the elastic portion of the demand curve. Hence, equilibrium is only possible on the

elastic portion of the demand curve (Elasticity is greater than I).

The right answer is option A -

Question 18 of 999CB2023185

Question 18

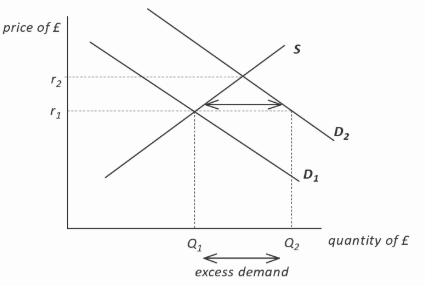

FlagThe introduction of a restrictive monetary policy in an open economy operating with a flexible exchange

rate would most likely lead to:Correct

The correct answer is A.

EXPLANATIONA restrictive monetary policy refers to the actions taken by the Fed or the central bank to reduce the money supply in

the economy. One of the primary tools used in restrictive monetary policy is raising interest rates. By increasing the

cost of borrowing (raising interest rates), central banks aim to discourage borrowing and spending, reducing overall

economic demand. In an open economy, an increase in domestic interest rates will lead capital to flow from abroad

to the domestic economy, where investors can earn a higher return on their investments. The inflow of capital from

abroad will lead to an increased demand for domestic currency, resulting in the appreciation of the domestic currency

(or exchange rate appreciation). Therefore, the correct answer is A.

NB: A currency appreciates when its value rises (because of high demand for that currency) relative to other

currencies and depreciates when its value falls (because of low demand for that currency).Incorrect

The correct answer is A.

EXPLANATIONA restrictive monetary policy refers to the actions taken by the Fed or the central bank to reduce the money supply in

the economy. One of the primary tools used in restrictive monetary policy is raising interest rates. By increasing the

cost of borrowing (raising interest rates), central banks aim to discourage borrowing and spending, reducing overall

economic demand. In an open economy, an increase in domestic interest rates will lead capital to flow from abroad

to the domestic economy, where investors can earn a higher return on their investments. The inflow of capital from

abroad will lead to an increased demand for domestic currency, resulting in the appreciation of the domestic currency

(or exchange rate appreciation). Therefore, the correct answer is A.

NB: A currency appreciates when its value rises (because of high demand for that currency) relative to other

currencies and depreciates when its value falls (because of low demand for that currency). -

Question 19 of 999CB2023188

Question 19

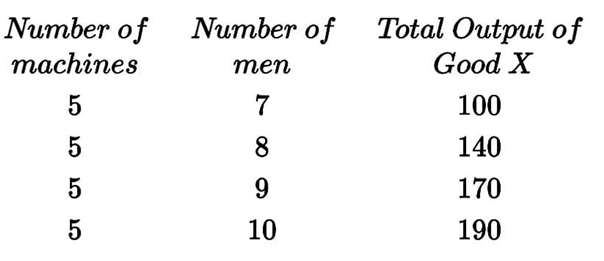

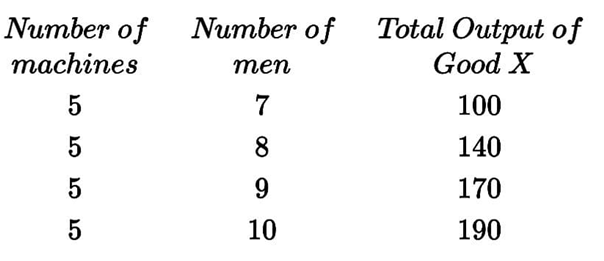

FlagThe following data is for a perfectly competitive firm producing Good X in the short run:

Which of the following statements about the marginal physical product per the table above is correct?

Correct

The correct answer is B.

EXPLANATIONThe following data is for a perfectly competitive firm producing Good X in the short run:

$\begin{array}{cccc}

\begin{array}{c}

\text { Number of } \\

\text { machines }

\end{array} & \begin{array}{c}

\text { Number of } \\

\text { men }

\end{array} & \begin{array}{c}

\text { Total Output of } \\

\text { Good X }

\end{array} & \begin{array}{c}

\text { Marginal } \\

\text { Physical Product }

\end{array} \\

5 & 7 & 100 & – \\

5 & 8 & 140 & 40 \\

5 & 9 & 170 & 30 \\

5 & 10 & 190 & 20

\end{array}$Marginal Physical Product = Change in Total Output of Good X from one additional unit of men – ~X.

From the table,

The marginal physical product of the 8th man = 40

The marginal physical product of the 9th man = 30

40>30

Note: Other options are incorrect based on the values in at the table.Incorrect

The correct answer is B.

EXPLANATIONThe following data is for a perfectly competitive firm producing Good X in the short run:

$\begin{array}{cccc}

\begin{array}{c}

\text { Number of } \\

\text { machines }

\end{array} & \begin{array}{c}

\text { Number of } \\

\text { men }

\end{array} & \begin{array}{c}

\text { Total Output of } \\

\text { Good X }

\end{array} & \begin{array}{c}

\text { Marginal } \\

\text { Physical Product }

\end{array} \\

5 & 7 & 100 & – \\

5 & 8 & 140 & 40 \\

5 & 9 & 170 & 30 \\

5 & 10 & 190 & 20

\end{array}$Marginal Physical Product = Change in Total Output of Good X from one additional unit of men – ~X.

From the table,

The marginal physical product of the 8th man = 40

The marginal physical product of the 9th man = 30

40>30

Note: Other options are incorrect based on the values in at the table. -

Question 20 of 999CB2023189

Question 20

FlagThe global financial crisis of 2007-2009 not only led to a worldwide recession but also a

Correct

The correct answer is C.

EXPLANATIONDuring the financial crisis, many European countries experienced significant economic downturns and faced

challenges in managing their public debt. The crisis revealed weaknesses in the financial systems of several

European countries, particularly those with high levels of government debt and fiscal imbalances. These countries

struggled to meet their debt obligations, leading to concerns about their solvency and the stability of the eurozone.

0

A

The sovereign debt crisis in Europe was characterized by escalating borrowing costs for affected countries, declining

investor confidence, and the need for financial assistance from international organizations such as the International

Monetary Fund and the European Central Banlc Several countries, including Greece, Ireland, Portugal, and later

Spain and Italy, faced severe economic and fiscal challenges, which required substantial bailout packages and

austerity measures to address the crisis.

Therefore, the most accurate response is C.Incorrect

The correct answer is C.

EXPLANATIONDuring the financial crisis, many European countries experienced significant economic downturns and faced

challenges in managing their public debt. The crisis revealed weaknesses in the financial systems of several

European countries, particularly those with high levels of government debt and fiscal imbalances. These countries

struggled to meet their debt obligations, leading to concerns about their solvency and the stability of the eurozone.

0

A

The sovereign debt crisis in Europe was characterized by escalating borrowing costs for affected countries, declining

investor confidence, and the need for financial assistance from international organizations such as the International

Monetary Fund and the European Central Banlc Several countries, including Greece, Ireland, Portugal, and later

Spain and Italy, faced severe economic and fiscal challenges, which required substantial bailout packages and

austerity measures to address the crisis.

Therefore, the most accurate response is C. -

Question 21 of 999CB2023190

Question 21

FlagWhich of the following will result in an improvement in the domestic country’s terms of trade?

Correct

The correct answer is D.

EXPLANATIONTerms of trade refer to the price index of exports divided by the price index of imports and then expressed as

a percentage. This means that the terms of trade will be 100 in the base year. Thus, if the average price of exports

relative to the average price of imports has risen by 20 percent since the base year, the terms of trade will now be

120. If the terms of trade rise (export prices rising relative to import prices), they are said to have ‘improved’, since

fewer exports now have to be sold to purchase any given quantity of imports. Changes in the terms of trade are

caused by changes in the demand for and supply of imports and exports and by changes in the exchange rate.

Hence, an improvement in the domestic country’s terms of trade will result from a rise in the average price of

exports relative to the average price of imports.Incorrect

The correct answer is D.

EXPLANATIONTerms of trade refer to the price index of exports divided by the price index of imports and then expressed as

a percentage. This means that the terms of trade will be 100 in the base year. Thus, if the average price of exports

relative to the average price of imports has risen by 20 percent since the base year, the terms of trade will now be

120. If the terms of trade rise (export prices rising relative to import prices), they are said to have ‘improved’, since

fewer exports now have to be sold to purchase any given quantity of imports. Changes in the terms of trade are

caused by changes in the demand for and supply of imports and exports and by changes in the exchange rate.

Hence, an improvement in the domestic country’s terms of trade will result from a rise in the average price of

exports relative to the average price of imports. -

Question 22 of 999CB2023191

Question 22

FlagWhich of the following is NOT a gain that countries may experience as a result of engaging in

international trade?Correct

The correct answer is B.

EXPLANATIONThe following are gains that countries may experience as a result of engaging in

international trade:

Decreasing costs – as countries specialise in a particular good they tend to experience economies of scale ( falling

unit costs), this can particularly arise within small countries where the local market is limited and presents no natural

opportunity for falling costs via expansion.

Differences in demand – one country may prefer a particular good to another and find that the demand for their

product is higher in another country. By engaging in trade, demand within both countries can be fulfilled.

Increased competition – imports from overseas can potentially create more

competition within a market and stimulate efficiency within the home market (if such competition were previously

lacking). This could lead to greater R&D and new

product development.

Trade as an engine of growth – increased demand elsewhere leading to a rise in

exports can help to stimulate growth within a country.

Non-economic advantages – other benefits may include political and social/cultural advantages as a result of

exposure to other firms across the world and differing ways of producing goods/services.

One argument for restricting international trade is to prevent Dumping. A country

may engage in dumping by subsidising its exports. The result is that prices may no longer reflect comparative costs .

The correct answer is: A country may engage in dumping by subsidising its exports.Incorrect

The correct answer is B.

EXPLANATIONThe following are gains that countries may experience as a result of engaging in

international trade:

Decreasing costs – as countries specialise in a particular good they tend to experience economies of scale ( falling

unit costs), this can particularly arise within small countries where the local market is limited and presents no natural

opportunity for falling costs via expansion.

Differences in demand – one country may prefer a particular good to another and find that the demand for their

product is higher in another country. By engaging in trade, demand within both countries can be fulfilled.

Increased competition – imports from overseas can potentially create more

competition within a market and stimulate efficiency within the home market (if such competition were previously

lacking). This could lead to greater R&D and new

product development.

Trade as an engine of growth – increased demand elsewhere leading to a rise in

exports can help to stimulate growth within a country.

Non-economic advantages – other benefits may include political and social/cultural advantages as a result of

exposure to other firms across the world and differing ways of producing goods/services.

One argument for restricting international trade is to prevent Dumping. A country

may engage in dumping by subsidising its exports. The result is that prices may no longer reflect comparative costs .

The correct answer is: A country may engage in dumping by subsidising its exports. -

Question 23 of 999CB2023192

Question 23

FlagWhich one of the following will NOT happen following a devaluation of the domestic currency on the

foreign exchange market?Correct

The correct answer is A.

EXPLANATIONDevaluation refers to fall in the value of a domestic currency relative to other country’s currencies. Devaluation

usually causes exports to be cheaper and imports to be more expensive for the domestic country. Since exports

become cheaper relative to other countries, the domestic country’s export volume will rise and import volume will

fall.Incorrect

The correct answer is A.

EXPLANATIONDevaluation refers to fall in the value of a domestic currency relative to other country’s currencies. Devaluation

usually causes exports to be cheaper and imports to be more expensive for the domestic country. Since exports

become cheaper relative to other countries, the domestic country’s export volume will rise and import volume will

fall. -

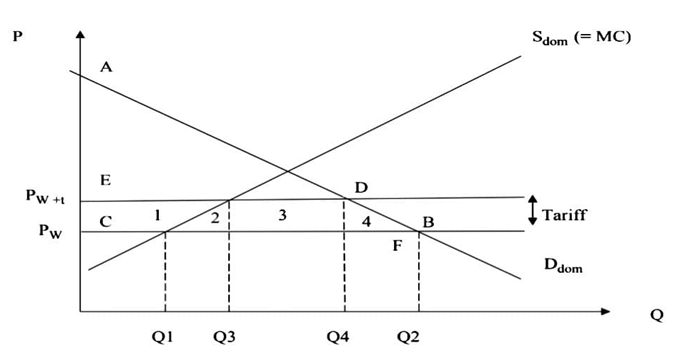

Question 24 of 999CB2023193

Question 24

FlagAll the following are economic costs of imposing an import tariff, EXCEPT?

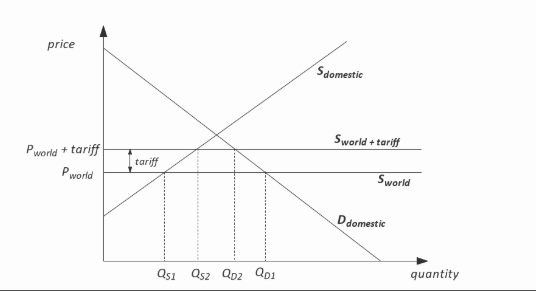

Correct

The correct answer is D.

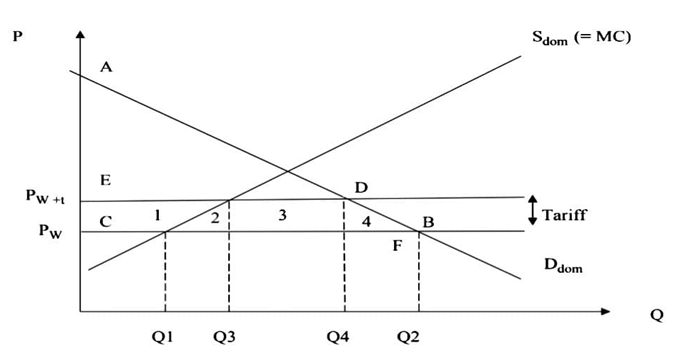

EXPLANATION

The cost of imposing a tariff is that consumers pay more as illustrated by the higher world price which now includes

the tariff and the resulting fall in consumer surplus. Before the tariff, consumer surplus is represented by the area

ABC. It falls to area ADE which represents a fall ofEDBC. The price rises from Pw to Pw+t. Domestic production

which was previously Q 1 increases to Q3 but consumption falls to Q4. Imports also fall to the difference between

Q4-Q3. Firms receive a higher price and therefore generate higher profits, represented by area 1. The government

receives income from the tariff represented by area 3. There are deadweight losses to society that are not recouped

anywhere and these losses are represented by areas 2 and 4 .

Therefore, the correct answer is: Rise in consumer surplus.Incorrect

The correct answer is D.

EXPLANATION

The cost of imposing a tariff is that consumers pay more as illustrated by the higher world price which now includes

the tariff and the resulting fall in consumer surplus. Before the tariff, consumer surplus is represented by the area

ABC. It falls to area ADE which represents a fall ofEDBC. The price rises from Pw to Pw+t. Domestic production

which was previously Q 1 increases to Q3 but consumption falls to Q4. Imports also fall to the difference between

Q4-Q3. Firms receive a higher price and therefore generate higher profits, represented by area 1. The government

receives income from the tariff represented by area 3. There are deadweight losses to society that are not recouped

anywhere and these losses are represented by areas 2 and 4 .

Therefore, the correct answer is: Rise in consumer surplus. -

Question 25 of 999CB2023194

Question 25

FlagThe following transactions take place in a simple closed economy. A company producing Good X sells its

output for £2 million. In producing Good X, the company buys raw materials for £800,000, uses £200,000 worth

of electricity, and has labour costs of £ 400, 000. What is the contribution of the company to the country’s Gross

Domestic Product (GDP)?Correct

The correct answer is C.

EXPLANATIONTo find the contribution of the company to the country’s Gross Domestic Product (GDP), we use the value-added

approach. That is,

GDP using the value-added method= Value of sales – Cost of intermediate goods

= £2,000,000 – (£800,000 + £200,000 + £400,000) = £600,000Incorrect

The correct answer is C.

EXPLANATIONTo find the contribution of the company to the country’s Gross Domestic Product (GDP), we use the value-added

approach. That is,

GDP using the value-added method= Value of sales – Cost of intermediate goods

= £2,000,000 – (£800,000 + £200,000 + £400,000) = £600,000 -

Question 26 of 999CB2023196

Question 26

FlagThe marginal propensity to consume is 0.8, the rate of income tax is 25% of all income, and government

expenditure is £50 million. Which one of the following statements is TRUE?Correct

The correct answer is C.

EXPLANATIONConsider a simple Keynesian model: GDP= C + G with T = 0.25GDP such that C = 0.B(GDP- 0.25GDP)

where C = aggregate consumption function; G = government expenditure; T = taxes and GDP= income.

This implies that,

GDP= 0.B(GDP- 0.25GDP) + G

GDP= 0.6GDP + G

GDP-0.6GDP = G

0.4GDP = G

GDP= 2.5G

: . The government expenditure multiplier is 2.5, i.e., an increase in government expenditure of £10 million will

increase the national income by £25 million.Incorrect

The correct answer is C.

EXPLANATIONConsider a simple Keynesian model: GDP= C + G with T = 0.25GDP such that C = 0.B(GDP- 0.25GDP)

where C = aggregate consumption function; G = government expenditure; T = taxes and GDP= income.

This implies that,

GDP= 0.B(GDP- 0.25GDP) + G

GDP= 0.6GDP + G

GDP-0.6GDP = G

0.4GDP = G

GDP= 2.5G

: . The government expenditure multiplier is 2.5, i.e., an increase in government expenditure of £10 million will

increase the national income by £25 million. -

Question 27 of 999CB2023197

Question 27

FlagWhich of the following is most likely to lead to a rise in aggregate demand?

Correct

The correct answer is D.

EXPLANATIONAggregate Demand (AD) is normally referred to as aggregate expenditure (E). Aggregate expenditure consists of the

consumption of domestically produced goods Cd plus the three injections (J): investment in the domestic economy

(I), government purchases in the domestic economy (G) and expenditure from abroad on the country’s exports (X).

AD=E=Cd+J

An increase in the income tax rate will reduce the disposable income for people to spend on consumption; therefore,

aggregate demand reduces

A decrease in government expenditure reduces injections therefore, aggregate demand reduces

A decrease in the value of exports reduces reduces injections therefore, aggregate demand reduces

A decrease in the rate of interest means people will be encouraged to borrow to invest in production at a lower

cost which increases aggregate demand.Incorrect

The correct answer is D.

EXPLANATIONAggregate Demand (AD) is normally referred to as aggregate expenditure (E). Aggregate expenditure consists of the

consumption of domestically produced goods Cd plus the three injections (J): investment in the domestic economy

(I), government purchases in the domestic economy (G) and expenditure from abroad on the country’s exports (X).

AD=E=Cd+J

An increase in the income tax rate will reduce the disposable income for people to spend on consumption; therefore,

aggregate demand reduces

A decrease in government expenditure reduces injections therefore, aggregate demand reduces

A decrease in the value of exports reduces reduces injections therefore, aggregate demand reduces

A decrease in the rate of interest means people will be encouraged to borrow to invest in production at a lower

cost which increases aggregate demand. -

Question 28 of 999CB2023198

Question 28

FlagThe conventional Phillips Curve illustrates the inverse relationship between:

Correct

The correct answer is C.

EXPLANATIONThe conventional Phillips Curve demonstrates an inverse relationship between unemployment and inflation,

suggesting that lower unemployment rates are associated with higher inflation, and vice versa. Therefore, the

correct answer is option CIncorrect

The correct answer is C.

EXPLANATIONThe conventional Phillips Curve demonstrates an inverse relationship between unemployment and inflation,