CM2 Financial Engineering & Loss Reserving

WHAT ARE THE DIFFERENT FORMS OF EFFICIENT MARKETS?

Efficient market consists of: weak form market where market prices reflect all of the information contained in historical price data, semi-strong form is one where market prices reflect all publicly available information & strong form is where market prices reflect all information, whether or not it is publicly available.

WHAT IS MEANT BY UTILITY?

In economics, ‘utility’ is the satisfaction that an individual obtains from a particular course of action.

WHAT IS THE SHAPE OF UTILITY CURVE FOR A RISK-AVERSE INVESTOR?

for a risk-averse investor, utility is a (strictly) concave function of wealth which reflects that the marginal utility of wealth (strictly) decreases with the level of wealth and consequently each additional dollar, say, adds less satisfaction to the investor than the previous one.

WHAT IS ABSOLUTE AND RELATIVE RISK AVERSION?

if the absolute value of the certainty equivalent decreases (increases) with increasing (decreasing) wealth, the investor is said to exhibit declining absolute risk aversion. If the absolute value of the certainty equivalent decreases (increases) as a proportion of total wealth as wealth increases the investor is said to exhibit declining (increasing) relative risk aversion.

WHAT IS VARIANCE OF RETURN?

Variance of return refers to change in the market value of the asset about the mean value.

WHAT IS DOWN-SIDE VARIANCE? WHY IS IT IMPORTANT?

Downside semi variance helps to calculate the possibility of low returns. It is the risk of actual values being less than expected values.

WHAT DO YOU UNDERSTAND BY VALUE AT RISK?

VaR represents the maximum potential loss on a portfolio over a given future time period with a given degree of confidence. It calculates the likelihood of underperforming.

WHAT IS PORTFOLIO THEORY?

Mean-variance portfolio theory leads to optimum portfolios where investors can be assumed to have quadratic utility functions & if returns are assumed to be normally distributed.

DESCRIBE DIFFERENT TYPES OF MULTI-FACTOR MODELS?

macroeconomic, fundamental and statistical factor models.

WHAT ARE THE BASIC ASSUMPTIONS OF CAPITAL ASSET PRICING METHOD?

The basic assumptions of CAPM are investors are risk-averse and non-satiated, no transact

WHAT IS A MARTINGALE?

A martingale is a process whose current value is the best estimate of its future values. So, the expected future value is the current value or that the process has ‘no drift’.

STATE SOME PROPERTIES OF A STANDARD BROWNIAN MOTION.

A Wiener process is a stochastic process with independent and stationary increments, also it has normally distributed increments, along with continuous sample paths.

ARE STOCHASTIC PROCESSES GOOD MODELS FOR ASSET PRICES?

No, since asset prices do not start at zero, are not continuous and they certainly don’t exhibit normally distributed increments.

STATE WHAT IS MEANT BY ARBITRAGE?

An arbitrage opportunity is a situation where we can make a certain profit with no risk.

OUTLINE THE FACTORS THAT AFFECT OPTION PRICES.

There are usually 5 factors affecting option prices: the underlying share price, the strike price, the time to expiry, the volatility of the underlying share and the risk-free interest rate.

EXPLAIN WHAT IS MEANT BY PUT-CALL PARITY.

In an arbitrage free market, two portfolios which have the same value at expiry, for example, A: consisting of a European call plus cash, B: consisting of the underlying share plus a European put with the same expiry date and exercise price as the call, and since the options cannot be exercised before then they should have the same value at any time.

NAME DIFFERENT TYPES OF OPTION GREEKS.

The Greeks are a group of mathematical derivatives that can be used to help us to manage or understand the risks in our portfolio. Greeks are: delta, gamma, theta, rho and vega.

IS THERE ANY DIFFERENCE BETWEEN EUROPEAN AND AMERICAN OPTION?

A European option is an option that can only be exercised at expiry. An American option is one that can be exercised on any date before its expiry.

EXPLAIN THE DIFFERENCE BETWEEN THE REAL-WORLD MEASURE AND THE RISK-NEUTRAL MEASURE.

Risk-neutral measure is the probability measure with respect to which any asset, whether risky or risk-free, offers the same expected return to investors, namely, the risk-free rate of return. However, in the real-world, investors do need extra return for the amount of risk undertaken.

WHAT ARE RUN-OFF TRIANGLES?

Run-off triangles are two-dimensional matrices that help in estimating the ultimate cost of claims under general insurance business.

STATE HOW RUN-OFF TRIANGLES ARE USED FOR RESERVE CALCULATIONS?

The method is based on an accident-year basis where claims development is clustered by the year an accident has occurred. The task is to decide the amounts yet to be paid in respect of the given accident years by calculating respective development factors and accumulating the claims already paid and finally, finding the incremental claims to be paid.

WHAT IS CREDIT RISK? GIVE AN EXAMPLE WITH REFERENCE TO INSURANCE COMPANY

Credit risk is the possibility of a loss resulting from a borrower’s failure to repay a loan or meet contractual obligations. In the simplest terms, it is the risk that a counterparty who owes you money, or is supposed to perform a financial duty and will default on that promise. For e g- Reinsurance Recoverables

Insurance companies often buy their own insurance, known as reinsurance, to protect themselves against massive claims.If a major catastrophe occurs (like a hurricane) and the primary insurer pays out millions to policyholders, they expect to be reimbursed by their reinsurer. If the reinsurer becomes insolvent or refuses to pay, the primary insurer is left holding the entire loss.

WHAT IS TERM STRUCTURE?

In finance, the term structure of interest rates (often referred to as the yield curve) is the relationship between the interest rates (or yields) and the time to maturity for a given debt instrument in a specific currency.

Essentially, it shows how the “cost of borrowing” changes depending on how long you intend to borrow the money. To keep the comparison fair, the instruments analyzed usually have the same credit quality (e.g., government bonds).

EXPLAIN THE KEY THEORIES OF TERM STRUCTURE.

Three theories of Term structure are –

- Expectations Theory: Suggests that long-term rates are simply an average of current and expected future short-term rates.

- Liquidity Preference Theory: Argues that investors prefer short-term, liquid assets and must be compensated with higher rates (a liquidity premium) to hold long-term debt.

- Market Segmentation Theory: Assumes that the markets for short-term and long-term bonds are completely different, with yields determined by the specific supply and demand within each “segment”.

EXPLAIN EXPECTED LOSS

Expected Loss is a fundamental concept in insurance and risk management. It represents the average amount of money an individual or an insurance company can anticipate losing from a specific risk over a given period.

Expected loss is calculated by combining two primary factors:

- Probability of Loss (Frequency): How likely is it that the negative event will occur? In insurance, this is often expressed as the claim frequency rate (e.g., a 5% chance of a car accident in a year).

- Severity of Loss (Impact): If the event does occur, how much will it cost on average? This is the average size of a claim (e.g., the average car crash costs $4,000 to fix).

WHAT DO YOU MEAN BY ALM WITH REFERENCE TO AN INSURANCE COMPANY.

Asset-Liability Management (ALM) is a strategic framework used by insurance companies to coordinate the management of their assets (investments) and their liabilities (future claim payouts) so that they can meet their financial obligations while maximizing profit.

In an insurance company, the liabilities are the promises made to policyholders. Because these payouts often happen years or decades in the future, the company must invest the premiums it collects today in a way that ensures the money will be there when the claims arrive.

WHAT IS AN OPERATING CYCLE?

In general business terms, the operating cycle is the total time it takes for a company to convert its investment in inventory and other resources back into cash. It is a key measure of a company’s operational efficiency and liquidity.

EXPLAIN VAR AND TAIL VAR. GIVE AN EG WITH REFERENCE TO AN INSURANCE COMPANY.

Tail Value at Risk (Tail VaR), also known as Expected Shortfall, is a risk measure that quantifies the expected loss in the “worst-case” scenarios.

While standard Value at Risk (VaR) tells you the maximum loss you might face with a certain confidence level (e.g., “There is a 95% chance we won’t lose more than 1 million dollars”), it tells you nothing about what happens if you do cross that threshold.

Imagine an insurance company, that covers homes against flood damage.

The company’s actuaries model potential annual claims. They determine that at a 99% confidence level, the VaR is 500 million dollars.

Interpretation: There is only a 1% chance that annual flood claims will exceed 500 million dollars.

WHY IS TAIL VAR PREFERRED OVER VAR?

Tail VaR accounts for the severity of extreme events (black swans), whereas VaR is blind to the magnitude of losses beyond the threshold.

WHAT IS MEANT BY RUN-OFF TRIANGLE?

Run-off is most commonly associated with a Development Triangle or Loss Triangle. This is a tool used to estimate IBNR (Incurred But Not Reported) claims.It tracks how claims for a specific group of policies “develop” over time. By looking at the “run-off” of past claims, actuaries can predict how much money needs to be set aside today to cover claims that have happened but haven’t been fully paid yet.

EXPLAIN THE METHODS FOR CALCULATING RESERVES

– Basic Chain Ladder Method – It assumes that the cumulative claims for a given accident year will grow by a constant factor from one development period to the next.

– Inflation-Adjusted Chain Ladder Method – Strip out the effect of inflation from the historical data to bring all claim amounts to constant prices (current day value).

– Bornhuetter-Ferguson (BF) Method – This is a “Credibility” based approach, combining the company’s internal data with an external “Prior” estimate. The BF method combines what is expected with what has actually happened.

– Average Cost per Claim Method -Project the number of claims that will eventually be settled using a Chain Ladder. Simultaneously, you project the average cost (severity) of those claims.

WHAT IS THE DIFFERENCE BETWEEN CHAIN LADDER AND BF METHOD?

Chain Ladder : It takes the claims observed to date and multiplies them by a development factor to estimate the final total. If you have ₹10 in claims and a factor of 5, it projects ₹50.

BF Method: It takes the claims observed to date and adds the unseen portion of an initial expected loss. If you expected ₹100 total and 80% is still unseen, it adds ₹80 to whatever you have already paid.

Accident Year: 2025

Total Premiums Collected: ₹1,000,000

Expected Loss Ratio (initial guess): 60% (So, Initial Expected Loss = ₹600,000)

Claims Paid so far (after 1 year): ₹50,000

Chain Ladder Factor: 10.0 (This means the company expects total claims to be 10 times what they see in Year 1).

The Chain Ladder looks only at the ₹50,000 paid and the multiplier.

- Calculation: ₹50,000 *10.0

- Ultimate Loss Estimate: ₹500,000

- The Problem: This method is “blind.” If Year 1 was just lucky and had very few claims, the Chain Ladder assumes the entire life of the policy will be lucky. It ignores the fact that we originally expected to pay out ₹600,000.

Method 2: Bornhuetter-Ferguson (The Add-on)

The BF method uses the ₹50,000 but stays grounded in the original ₹600,000 expectation.

- Percentage Emerged: Since the factor is 10.0, only 10% of claims have shown up (1 / 10).

- Percentage Unemerged: Therefore, 90% of the work is still unseen.

- Expected Future Claims: 90% of our original ₹600,000 = ₹540,000

Ultimate Loss Estimate: ₹50,000 (Actual)+ ₹540,000 (Expected Future) =₹590,000.

Capital Asset Pricing Model (CAPM) is primarily used to determine the required return on the assets held in the company’s investment portfolio to ensure they can cover future policyholder claims.Insurance companies are essentially giant investment funds that happen to sell protection. CAPM helps them decide how to balance the “Risk vs. Return” of the premiums they collect.

HOW CAN BROWNIAN BE USED IN PRACTICAL LIFE?

Brownian Motion is the mathematical description of a random walk. It describes how the position of a particle like a stock price changes over time when it is being constantly bumped by many small, random forces.

Actuaries use Brownian Motion to model an insurance company’s surplus (the money left over after paying claims). Premiums flow in steadily (the upward drift), but claims occur at random times and in random amounts (the “bumps”).

In simple actuarial terms, Brownian Motion is the underlying stochastic process used to model the “random walk” of uncertain variables, such as an insurance company’s surplus or a stock’s price, over time.

Black-Scholes, on the other hand, is a valuation framework that applies the math of Brownian Motion to find the “fair value” of a financial risk.

While an actuary uses Brownian Motion to calculate the Probability of Ruin (the chance of going bust due to random claims), they use Black-Scholes to price the Embedded Derivatives or guarantees within a policy, ensuring the company collects enough premium to hedge against those random market movements.

RUNOFF

A. General Run-off & Reserving

What is reserving in general insurance?

Reserving is the process of estimating future claim payments arising from past events, including outstanding reported claims, IBNR, reopened claims, and claims handling expenses.

What is a run-off (delay) triangle?

A run-off triangle is a tabular arrangement of claims data by accident year and development year, used to analyse claim development patterns and project ultimate claims.

Why are run-off triangles important?

They help identify development patterns, estimate ultimate claims, and assess reserve adequacy.

What types of data are used in run-off triangles?

Cumulative claims, incremental claims, claim counts, or average cost per claim data.

B. Basic Chain Ladder (BCL)

What is the basic chain ladder method?

It projects future claims by assuming past development patterns will continue, using development factors derived from cumulative claims data.

How are development factors calculated in BCL?

By dividing cumulative claims at development year ( j+1 ) by cumulative claims at development year ( j ), usually using weighted averages.

How are future claims projected under BCL?

By multiplying observed cumulative claims by the relevant development factors to estimate ultimate claims.

What are the key assumptions of the basic chain ladder method?

- First accident year is fully run-off

- Claims in each development year are a constant proportion (in monetary terms) of ultimate claims

- Inflation is allowed implicitly, not explicitly

What are the limitations of the BCL method?

It assumes stable claim development and does not explicitly allow for inflation or changes in claims handling.

C. Inflation-Adjusted Chain Ladder

Why do we need an inflation-adjusted chain ladder?

To explicitly separate claims inflation from underlying claim development patterns.

How is inflation handled in this method?

Past claims are adjusted to the price level of the most recent accident year using known inflation factors.

What are the steps in the inflation-adjusted chain ladder method?

- Inflate incremental data to current price level

- Accumulate data and calculate development factors

- Project future cumulative claims

- De-accumulate projected claims

- Apply future inflation assumptions to obtain nominal cashflows

What assumptions are made in the inflation-adjusted chain ladder?

- First accident year is fully run-off

- Claims develop in constant proportions in real terms

- Past and future inflation assumptions are correct

When is this method preferable to BCL?

When inflation is volatile or materially affects claim amounts.

D. Average Cost Per Claim (APPC)

What is the average cost per claim method?

It estimates ultimate claims by projecting claim numbers and average claim amounts separately.

How is the average cost per claim calculated?

By dividing cumulative claims amounts by cumulative claim numbers for each cell.

How is the APPC method implemented?

- Calculate APPC

- Apply development factors to APPC

- Project claim numbers

- Multiply projected APPC by projected claim numbers

What assumptions does the APPC method make?

- First accident year is fully run-off

- Average cost develops as a constant proportion of ultimate average cost

- Claim numbers develop as a constant proportion of ultimate claim numbers

- Inflation is allowed implicitly

When is APPC preferred?

When claim frequency and severity show different development patterns.

E. Bornhuetter–Ferguson (BF) Method

What is the Bornhuetter–Ferguson method?

It combines an a priori estimate of ultimate loss (usually from a loss ratio) with observed claims development.

What inputs are required for the BF method?

- Earned premium

- Selected loss ratio

- Development factors

How is the BF ultimate loss estimated?

Ultimate loss = Reported claims + Expected future claims

Expected future claims = Initial ultimate estimate × proportion unreported

Why is BF considered more stable than BCL?

Because it relies less on early development data, which can be volatile.

What are the assumptions of the BF method?

- First accident year is fully run-off

- Loss ratio is correct

- Claims develop as a constant proportion of ultimate claims

- Inflation is allowed implicitly

- When is the BF method particularly useful?

For immature accident years with little reported claims data.

F. Comparison & Insight Questions

Compare BCL and BF methods.

BCL relies entirely on observed data, while BF combines observed data with prior expectations.

How does inflation treatment differ across methods?

- BCL & BF: Inflation implicit

- Inflation-adjusted CL: Inflation explicit

What happens if the loss ratio assumption is wrong in BF?

The ultimate loss estimate will be biased.

Why must the first accident year be fully run-off?

It provides a benchmark for estimating development patterns.

How would you choose between these reserving methods?

Based on data maturity, inflation environment, stability of loss ratios, and business judgment.

Others

What are the main types of General Insurance?

The industry mainly covers Motor, Health, Property, Liability, Travel, and Marine insurance. I categorize them as Short-Tail (motor, health—claims settle quickly) and Long-Tail (liability, some property—claims may take years), which impacts pricing and reserving strategy.

How do you define Risk in General Insurance?

Risk is the uncertainty of a loss event occurring and its financial impact. I focus on both Frequency (how often claims occur) and Severity (the financial magnitude).

For pricing, both parameters are crucial to ensure premiums cover expected claims and expenses.

Explain the Law of Large Numbers in insurance.

It underpins the predictability of risk pools. The more independent exposures I have, the closer the actual losses will be to expected losses. For example, in motor insurance, thousands of similar vehicles allow me to estimate claims accurately using historical data.

What is Underwriting and why is it critical?

Underwriting is the assessment and selection of risks to decide coverage terms and pricing. I use it to balance profitability vs. risk acceptance. Poor underwriting can lead to adverse selection, which inflates loss ratios and reduces solvency.

- How do Insurers calculate Premiums?

Premium = Expected Loss + Expenses + Risk Margin + Profit Loading. I model frequency and severity, adjust for risk exposures, and include reinsurance costs. I always check whether the premium is actuarially fair yet competitive.

Explain Loss Ratio, Combined Ratio, and Expense Ratio.

● Loss Ratio: Claims / Premium

● Expense Ratio: Operating Expenses / Premium

● Combined Ratio: Loss + Expense Ratios; <100% implies underwriting profit.

What is IBNR (Incurred But Not Reported)?

IBNR is the reserving for claims that have occurred but not yet reported. I calculate it using historical claims data, development factors, and statistical methods like Chain-Ladder to ensure sufficient reserves.

How do you approach Reserving for Long-Tail Lines?

For long-tail lines like liability or workers’ compensation, I use stochastic reserving models, trend analysis, and scenario testing. I also consider discounting and inflation, because cash flows may occur years after the policy period.

What is Reinsurance and why is it used?

Reinsurance is insurance for insurers. I use it to transfer catastrophic risk, stabilize loss ratios, and protect solvency. Common structures include Excess of Loss (catastrophe protection) and Quota Share (proportional sharing).

Explain Catastrophe Modeling in General Insurance.

Cat modeling predicts losses from rare but severe events (earthquakes, floods, cyclones). I simulate scenarios using historical data, exposure maps, and probabilistic models, which informs pricing, reinsurance, and capital allocation.

How do you price Motor Insurance?

I analyze vehicle type, engine size, driver age, location, claim history, and apply risk loadings. For commercial vehicles, I may also include fleet-level adjustments. I ensure actuarial justification while remaining competitive in the market.

How do Health Insurance claims differ from Motor claims?

Health insurance claims are high frequency but low to medium severity and are often influenced by moral hazard and medical inflation. Motor claims are more random and short-tail. I adjust pricing and reserves accordingly.

What is a No-Claim Bonus (NCB)?

NCB incentivizes claim-free policyholders with premium discounts. I factor in NCB while calculating expected claims, as it reduces the insurer’s net loss probability.

How do you handle Rating Cycles in General Insurance?

Insurance markets have soft and hard cycles. In a soft market, competition drives premiums down; in a hard market, claim experience prompts increases. I adjust pricing using credible loss ratios and market intelligence, ensuring solvency.

How do you assess Profitability of a Product Line?

I analyze Loss Ratio, Expense Ratio, Reinsurance Costs, and Investment Income. I also consider Regulatory Capital Charges and Reserve Adequacy. A product may be profitable on investment income but loss-making on underwriting—both aspects must be considered.

What is Solvency II / IRDAI Solvency Requirement?

Solvency is the ability to meet obligations to policyholders. I monitor the Solvency Ratio (Assets / Required Capital) to ensure compliance. I also consider stress testing, capital buffers, and economic capital models.

Explain the concept of Risk-Based Capital.

Risk-Based Capital (RBC) ties capital requirement to actual risk exposure. I assess underwriting risk, market risk, credit risk, operational risk, ensuring the insurer maintains sufficient capital to cover extreme scenarios.

How do you assess Operational Risk in a General Insurance company?

I evaluate risks like fraud, system failure, regulatory breaches, and claims leakage. I apply qualitative assessments and quantitative capital charges. Risk mitigation measures include controls, audits, and process redesigns.

What is the impact of Inflation on General Insurance?

Inflation increases claim severity, especially in health and property lines. I index premiums and reserves to expected inflation trends, ensuring underwriting profitability remains intact.

How do Investments differ in a Non-Life Company?

Since claims are short-tail, liquidity is critical. I focus on short-term fixed income, high-grade corporate bonds, and treasury bills, balancing yield with ability to meet unexpected claim spikes.

How do you manage Catastrophic Risk?

I diversify exposures geographically, structure Excess of Loss Reinsurance, and maintain Catastrophe Reserves. I also simulate extreme scenarios to ensure solvency under tail events.

How do you explain a sudden rise in Loss Ratio to Management?

I segment by line, product, and geography, identify underpricing, claim spikes, or operational errors, and assess reinsurance effectiveness. I present actionable insights to adjust pricing, underwriting, or claims management.

How do you evaluate New Products?

I model expected claims, expenses, pricing, and capital requirement, then run scenario and sensitivity analyses. I also assess market demand, competitive positioning, and regulatory compliance.

How do you address Fraud Risk?

I combine data analytics, claims pattern recognition, and audit trails to detect anomalies. I also ensure strong anti-fraud policies and employee awareness programs are in place.

Explain the role of Reinsurance in Pricing Stability.

Reinsurance smooths volatility from catastrophic claims, protects profit margins, and allows me to offer coverage for high-value risks without threatening solvency.

How do you handle Regulatory Changes?

I monitor IRDAI circulars, solvency requirements, and reporting standards. I model the financial impact, update pricing and reserving policies, and communicate changes clearly to stakeholders.

How do you assess Competitive Pricing?

I benchmark premium rates, coverage terms, and claim ratios, while ensuring actuarial soundness. I balance market share objectives with profitability.

How do you explain a Product Loss to the Board?

I contextualize losses using Loss Ratio, Combined Ratio, reserve adequacy, and solvency position. I focus on root causes—pricing, claims spikes, or operational inefficiency—and recommend corrective actions.

How do you incorporate Technology in General Insurance?

I leverage AI/ML models for fraud detection, pricing, and underwriting, and use analytics dashboards for real-time portfolio monitoring. Technology enhances risk selection and claims efficiency.

How do you assess Portfolio Diversification in Non-Life Insurance?

I analyze line-of-business correlations, geography, and policy types to ensure risk is not concentrated. Reinsurance and retrocession further diversify catastrophic exposures.

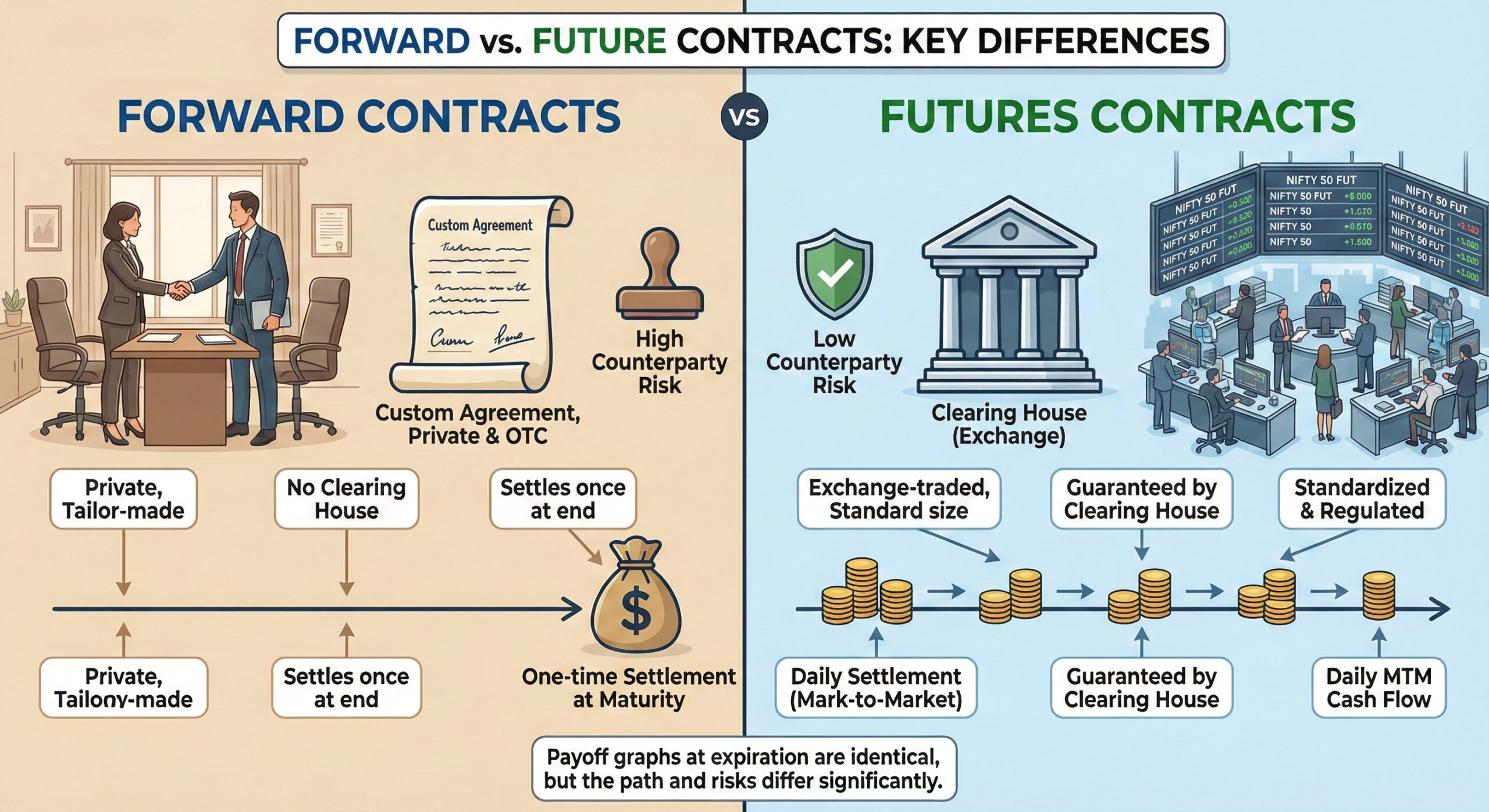

EXPLAIN THE DIFFERENCE BETWEEN FUTURES AND FORWARDS

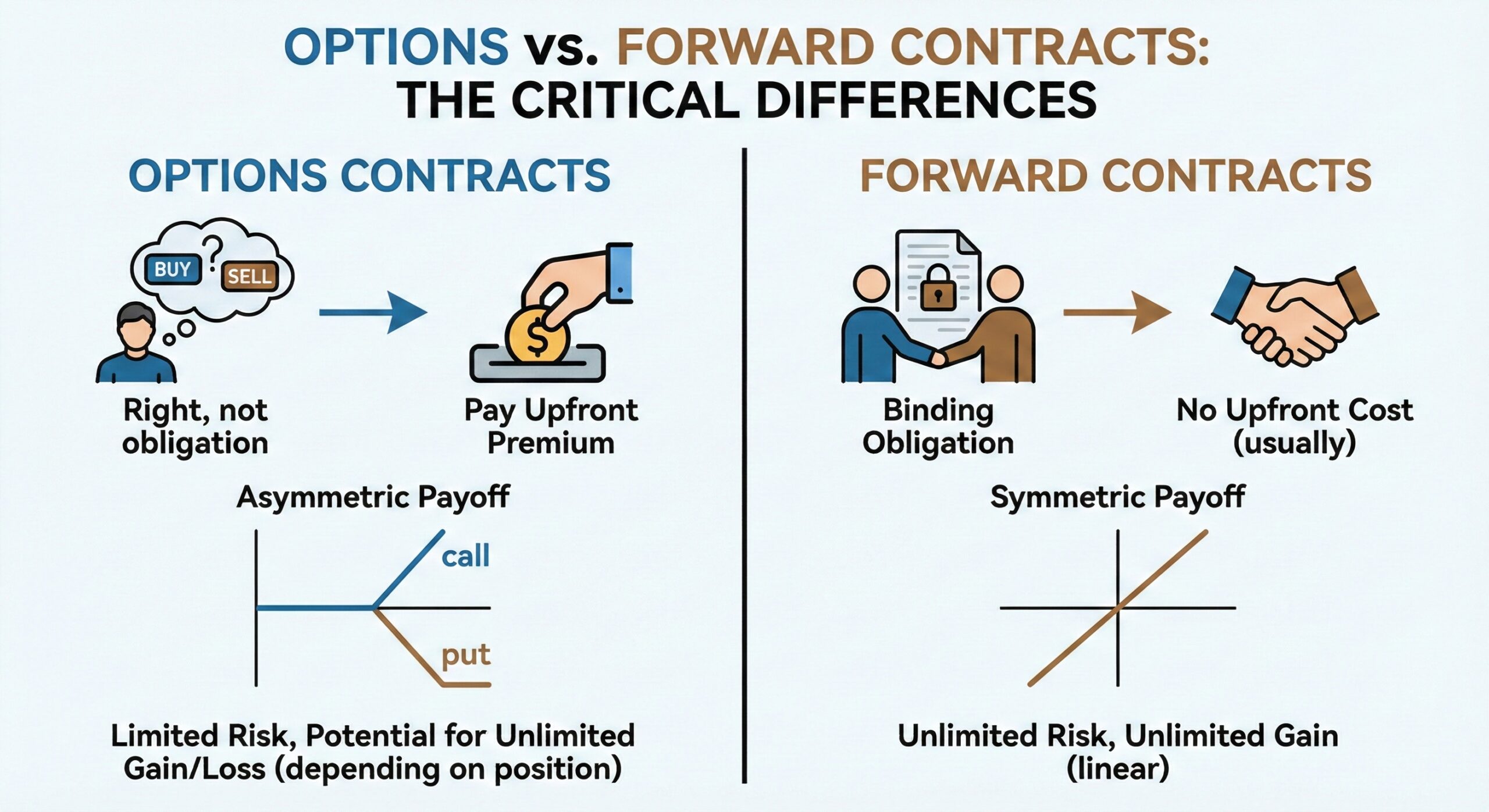

EXPLAIN THE DIFFERENCE BETWEEN FORWARDS AND OPTIONS

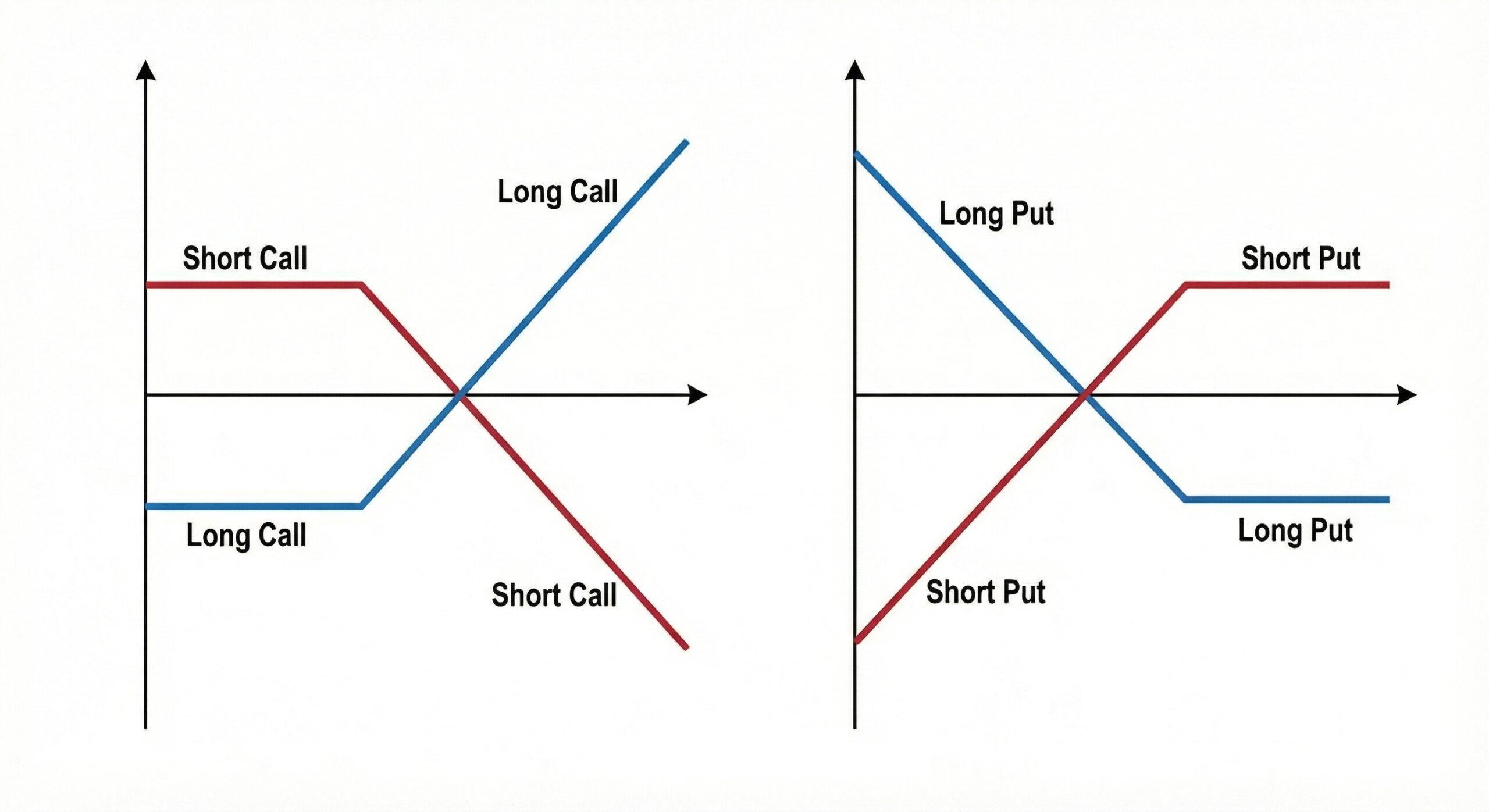

SHOW THE PAYOFF GRAPH