What does an actuary do?

Actuaries are professionals skilled in evaluating the financial consequences of uncertain future events. They utilize data science and analytics to create financial models that predict risks and uncertainties based on past trends and future forecasts. Their expertise also extends to reserving, data science, investment valuations, pricing, risk management, pensions.

Salary Structure

| Papers Cleared |

Experience |

Salary |

| 3-6 |

0-1 Year |

6-10 LPA |

| 6-10 |

1-2 Years |

10-15 LPA |

| 10 |

2-3 Years |

15-20 LPA |

| 11-12 |

3-4 Years |

20-25 LPA |

| Fellow |

4-6 Years |

25-35 LPA |

Disclaimer: The salary structure provided here is approximate and based on our past experience.

Who can become an Actuary?

By virtue of the role of an Actuary as a multi-skilled professional in core areas of financial risk and uncertainty, a candidate with strong skills in Mathematics, Statistics, Data Analytics and Finance with good analytical skills, logical reasoning coupled with a willingness to put work hard continuously to learn and pass all actuarial examination subjects, can be an ideal candidate.

Eligibility Criteria

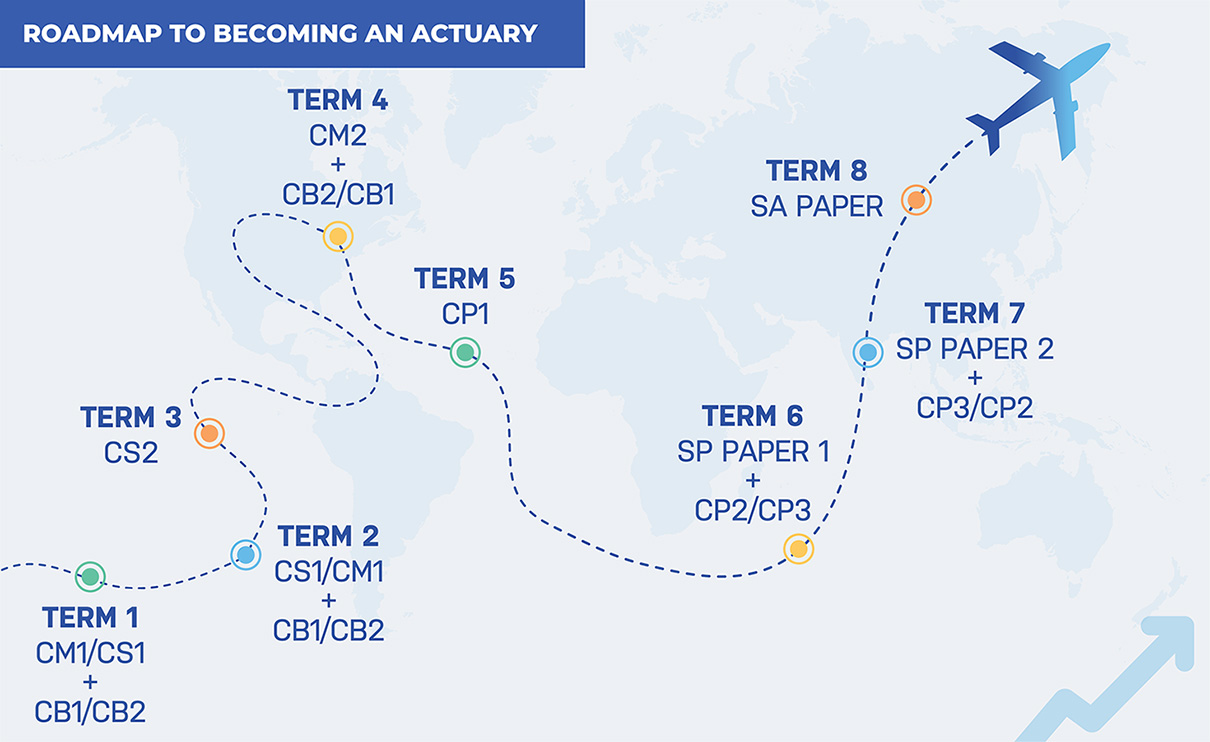

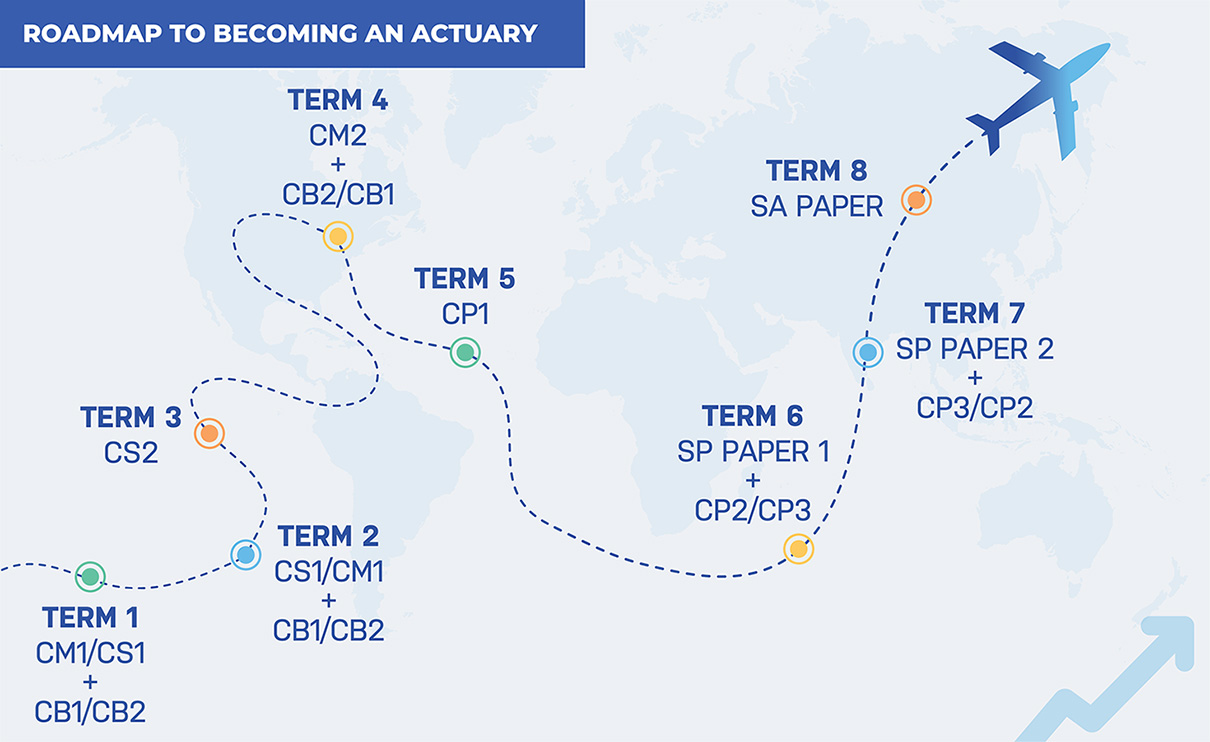

Associate Papers

CORE PRINCIPLES PAPERS (ALL)

-

CM1

Actuarial Mathematics

-

CM2

Economic Modelling

-

CS1

Actuarial Statistics

-

CS2

Risk Modelling & Survival Analysis

-

CB1

Business Finance

-

CB2

Business Economics

-

CB3

Business Management

Core Practice Papers (All)

-

CP1

Actuarial Practice

-

CP2

Modelling Practice

-

CP3

Communication Practice

Fellow Papers

Specialist Principles Papers (Any 2)

SP0

Master's Level ThesisSP1

Health and Care SP2

Life InsuranceSP4

PensionsSP5

Investment & FinanceSP6

Financial DerivativesSP7

General Insurance: ReservingSP8

General Insurance: PricingSP9

Enterprise Risk Management

Specialist Advanced Papers (Any 1)

SA0

Research Master's Level ThesisSA1

Health and Care SA2

Life InsuranceSA3

General InsuranceSA4

PensionsSA7

Investment & Finance

Society of Actuaries

Society of Actuaries (SOA) is the world’s largest Actuarial professional organization, with more than 34,000 members worldwide.

Comprehensive Education and Rigorous Standards.

Comprehensive Education and Rigorous Standards.

Global Recognition and Opportunities.

Global Recognition and Opportunities.

Diverse Practice Areas.

Diverse Practice Areas.

Commitment to Research & Professional Development.

Commitment to Research & Professional Development.

Strong Professional Network.

Strong Professional Network.

SOA e-learning modules

Pre-Actuarial Foundations Module

Pre-Actuarial Foundations Module

Advanced Topics in Predictive Analytics(ATPA) Assessment

Advanced Topics in Predictive Analytics(ATPA) Assessment

Fundamentals of Actuarial Practice (FAP) E-learning Course

Fundamentals of Actuarial Practice (FAP) E-learning Course

Actuarial Science Foundations Module

Actuarial Science Foundations Module

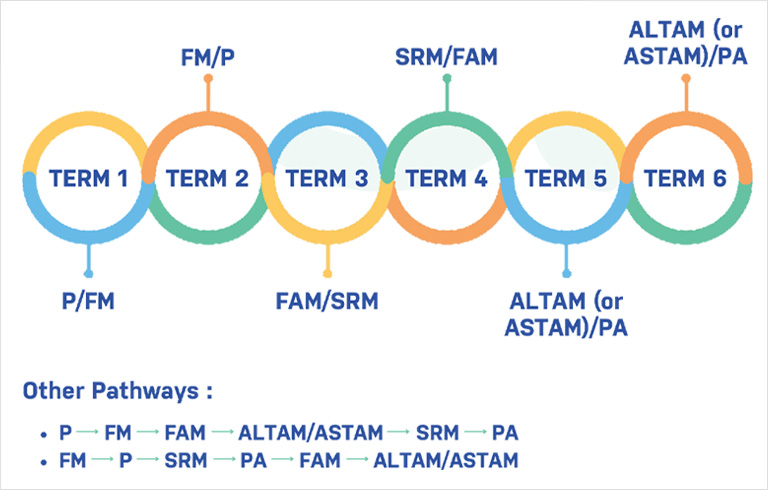

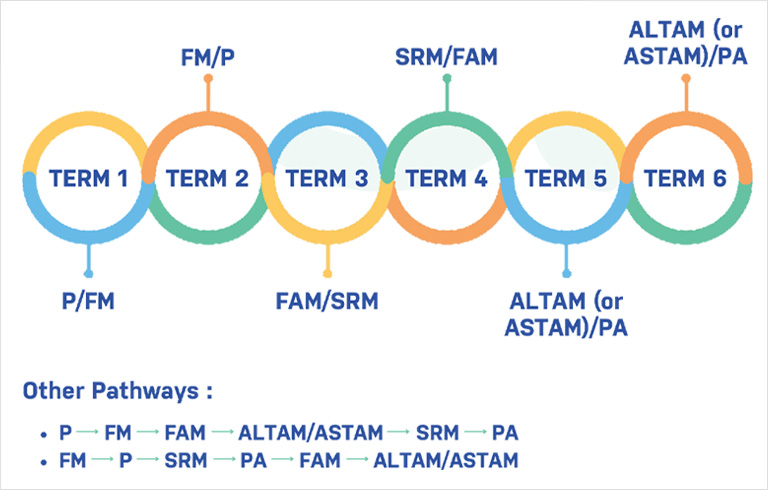

ASA Pathway

SOA ASSOCIATE PAPERS

P

ProbabilityFM

Financial MathematicsFAM

Fundamentals of Actuarial MathematicsSRM

Statistics for Risk ModellingPA

Predictive AnalyticsALTAM

Advanced Long/Short Term Actuarial Mathematics

VEE (Validation by Educational Experience)

In addition to the exams you will also have to clear 3 VEEs

VEE Mathematical Statistics

VEE Mathematical Statistics

VEE Accounting and Finance

VEE Accounting and Finance

VEE Economics (Micro and Macro)

VEE Economics (Micro and Macro)

It takes 30 hours or less to complete each VEE.

It takes 30 hours or less to complete each VEE.

You can get VEE exemption through your university course

You can get VEE exemption through your university course

Choosing between IAI | IFoA | SOA

| Basis |

IAI |

IFoA |

SOA |

| Established in |

India |

UK |

USA |

| Entrance Exam |

ACET |

No Exam |

No Exam |

| Exam Passing Percentage |

Volatile 20% to 65% |

30% to 50% |

30% to 50% |

| Exam Frequency |

All the exams are conducted twice a year. |

All the exams are conducted twice a year. |

Different for each paper. |

| Exam Format |

Exams for CM, CS and CB papers are 100% MCQ based. |

All the exams are subjective. |

P, FM, FAM & SRM are MCQ Based. |

16 years of age recommended 10+2 cleared.

16 years of age recommended 10+2 cleared. Students who are in intermediate college are also eligible

Students who are in intermediate college are also eligible Students can register for CM1 or CS1 (Any 1) without an IFoA membership. To appear for subsequent exams you must obtain IFoA membership.

Students can register for CM1 or CS1 (Any 1) without an IFoA membership. To appear for subsequent exams you must obtain IFoA membership.

Fully qualified members of the Institute of Chartered Accountants of India, Institute of Cost Accountants of India and Institute of Company Secretaries of India

Fully qualified members of the Institute of Chartered Accountants of India, Institute of Cost Accountants of India and Institute of Company Secretaries of India MBA in Finance (Minimum 60% or equivalent grade)

MBA in Finance (Minimum 60% or equivalent grade) IIM Graduate

IIM Graduate BSc/MSc in Actuarial Science from Institute/ Colleges

BSc/MSc in Actuarial Science from Institute/ Colleges B.E from Institute (Minimum 60% or equivalent grade)

B.E from Institute (Minimum 60% or equivalent grade) IIT Graduates

IIT Graduates Fellow Member of Insurance Institute of India

Fellow Member of Insurance Institute of India Passed two papers from any of the below actuarial bodies:

Passed two papers from any of the below actuarial bodies: Qualified 1st year Bsc.,Msc. Actuarial science from Amity University

Qualified 1st year Bsc.,Msc. Actuarial science from Amity University Graduation and Post-graduation diploma in Actuarial Science/ Statistics (PGDAS)

Graduation and Post-graduation diploma in Actuarial Science/ Statistics (PGDAS) Bcom in Actuarial Management Affiliated to Bharathiar University

Bcom in Actuarial Management Affiliated to Bharathiar University Bachelor/Masters of Statistics (Honours)/Mathematics (Honours) from Indian Statistical Institute

Bachelor/Masters of Statistics (Honours)/Mathematics (Honours) from Indian Statistical Institute Master of Science in Quantitative Economics [MS (QE)]/Quality Management Science [MS (QMS)] from Indian Statistical Institute

Master of Science in Quantitative Economics [MS (QE)]/Quality Management Science [MS (QMS)] from Indian Statistical Institute

Recommended 10+2 cleared

Recommended 10+2 cleared